While the economy is finally waking up from the Great Recession, millions of Americans are still feeling the hangover in the form of wage garnishments.

While the economy is finally waking up from the Great Recession, millions of Americans are still feeling the hangover in the form of wage garnishments.

Garnishments—the legal recovery of debt through the seizure of employee pay—have spiked in the past decade. Examples: Court-ordered or government-issued garnishments are up 121% in Phoenix since 2005 and 55% in Atlanta since 2004, according to a new ADP study.

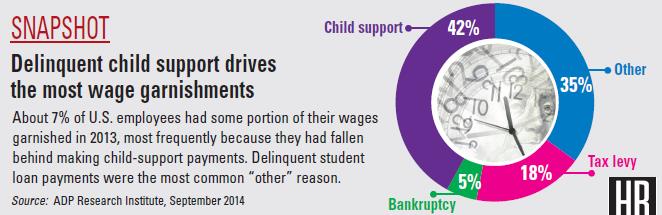

The survey found that 7.2% of U.S. workers had their wages garnished in 2013. The highest rate of garnishments (10.5%) was found among employees aged 35 to 44, the peak years for child-rearing, divorce and debt load. Child support is the leading cause.

Manufacturing leads all industries when it comes to the percentage of companies with garnished employees, followed by transportation and utilities. The Midwest has more garnishments than any other region.

“Businesses appear to be caught in the middle, striving to fulfil their obligations to employees under wage payment laws and to creditors under garnishment laws,” the ADP survey says.

What if a lender wants a piece of your employee’s paycheck? Here are five tips:

1. Always answer the garnishment! Even if you determine that you don’t have to make deductions or withholdings—perhaps the person no longer works for you—you still must answer and explain the reason. Ignoring the garnishment means the employee’s debt becomes your debt by default judgment.

2. Learn the kind of garnishment. An order for a noncontinuing garnishment requires a single payment, even if for less than the amount sought. In contrast, an order for continuing garnishment remains in effect for 180 days and requires a series of payments unless or until the garnishment is satisfied.

3. Don’t fire the employee. The federal Consumer Credit Protection Act (CCPA) and the laws of many states prohibit employers from discharging an employee based on a single garnishment (or multiple garnishments for a single indebtedness).

4. Learn the kind of indebtedness. Determine the type of indebtedness underlying the garnishment, as the amount of disposable earnings subject to garnishment varies. “Disposable earnings” means wages minus legally required withholdings.

In this regard, the CCPA limits the amount of earnings that may be garnished in any workweek or pay period to the lesser of 25% of disposable earnings or the amount by which disposable earnings are greater than 30 times the federal minimum wage.

On the other hand, in the case of child support or alimony, the CCPA allows up to 50% of an employee’s disposable earnings to be garnished if the employee is supporting a current spouse or child, and up to 60% otherwise.

5. Set up a system to identify wage garnishments. Quickly route them the person responsible for ensuring compliance. Don’t allow garnishments to linger in someone’s in-box. Train managers to immediately forward the paperwork to payroll or HR.